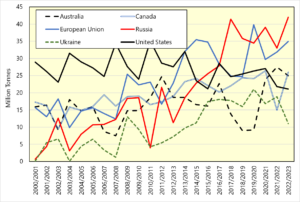

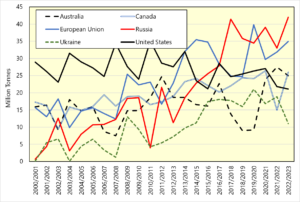

Over the past twenty years both Russian production and exports of wheat have grown to a point where Russia is the leading exporter of the grain. There has been similar growth in Ukraine, albeit to a lesser degree.

Exports of Wheat from Top Five Exporters and Ukraine

Source: USDA

While the area of wheat planted to wheat in Russia has grown by almost 6.2 million hectares since 1991, it is growth and stability of yield which has done much of the heavy lifting. At the breaking of the Soviet Union, Russian wheat yields were around 1.7 tonnes per hectare, now they are nearer three tonnes per hectare.

In Ukraine, excepting 2022, the area of wheat is broadly similar to 1991, as with Russia yields have grown.

The increasing importance of Russia and Ukraine on global wheat prices should be of little surprise. This is especially true given the impact of the last eight months on grain prices.

Beyond Russia and Ukraine, the shift to the East is evident.

The closest rival for Russia’s export crown is the EU. The same pattern of movement in key exporting nations from West to East is happening in the EU

In 2003/04, Central and Eastern Europe[1] accounted for 24% of total European wheat production. Twenty years on, the same block of countries is expected to account for 38% of production in 2022/23, an increase of twenty-seven million tonnes.

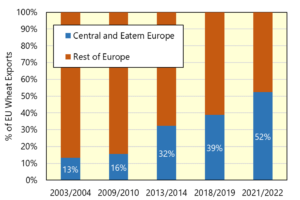

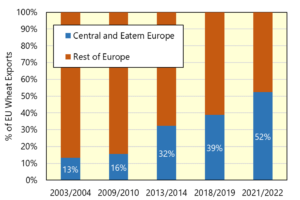

Share of EU wheat exports from Central and Eastern Europe

Source: Eurostat (EU Commission)

The same block is also seeing vast growth in its exports. Using a similar timeframe to the one above, over the last nineteen years (2003/04 to 2021/22) Central and Eastern Europe has grown its share of wheat exports from 13% of the EU (exc. UK) total to 52%. It is worth highlighting that the export figure is somewhat inflated by poor production in West Europe. That said, the direction of travel still holds.

So, why does this matter?

While anything remains possible, it seems likely that EU wheat supplies are safe from conflict, even with Romanian and Bulgarian wheat needing to pass through the Black Sea to the Bosporus Straight.

With the three key wheat futures markets, Chicago, Paris, and London, clearly not moving, crop conditions in the US and Western Europe are still key to sentiment. But we need to pay increasing attention to conditions in Eastern Europe.

The Paris futures exchange is based on a specification of wheat delivered into one of five locations on the west coast of France. Traditionally, we would consider our price relative to Paris futures as a marker of how competitive UK grain is on the world stage. France is still the top EU exporter, and comparisons to French prices remain important. However, it is now as important to consider the competitiveness of our export prices relative to Eastern Europe nations.

The UK has an exportable surplus of wheat this season, and the UK price will have to compete with EU values to find a home.

[1] Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia