Production

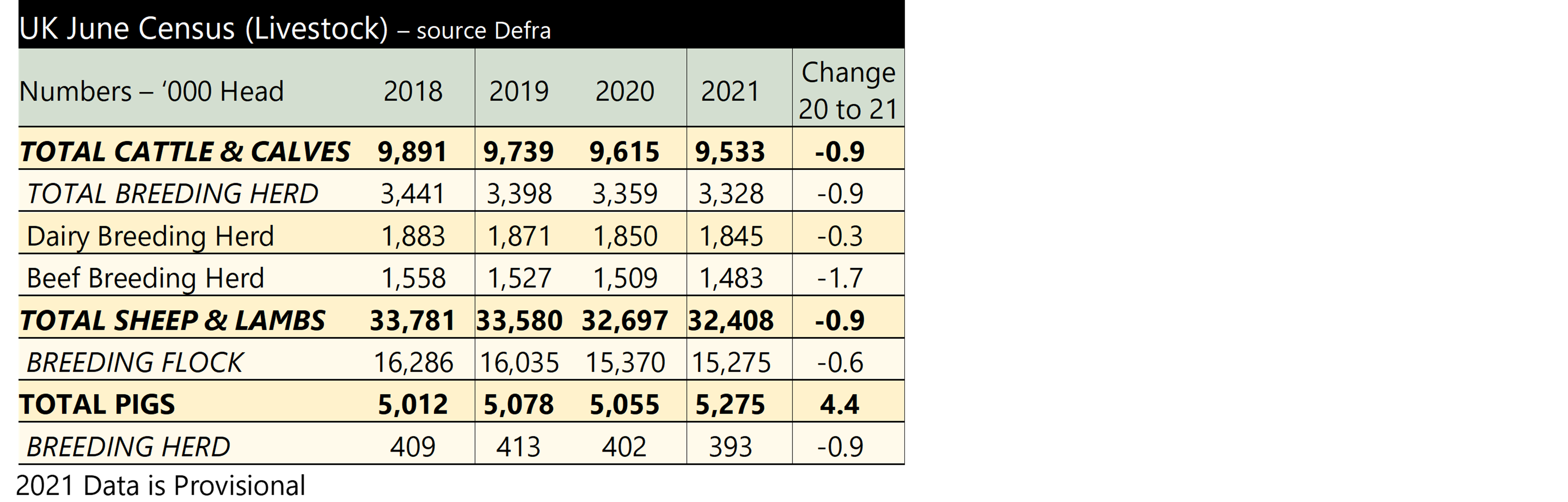

Global milk forecasts have been reduced as we head towards winter. The challenging weather and increase in feed costs, despite good prices (see below) has seen the combined growth forecast from the six largest largest exporters (EU-27, US, Australia, Argentina, NZ and the UK) reduced from 1.4% down to 1% for 2021. This equates to about 1.1bn litres.

But not all the countries have reduced their growth, some have increased. Both the US and the EU-27 have decreased their forecasts by about 1.4bn, but this has partially been offset by increases from Argentina and NZ. Increased production costs in the US is expected to result in a drop in cow numbers and yield in the second half of the year, meaning its forecast has been reduced, even so production from the US is still expected grow by 1.7% year-on-year. The EU-27 has reduced its annual growth to just 0.3%. Similar to the UK, challenging grass growing weather over the summer and high feed costs is impacting on yields; although there could be some recovery in the last quarter.

New Zealand and Argentina, on the other hand, are forecasting 1.9% and 2% growth for 2021. In NZ this has already been delivered and further growth compared to last year’s levels over the remainder of the year is unlikely. The UK and Australia are forecast to see growth of 0.4% and 0.9% respectively for the year.

Prices

With production globally and at home falling, prices continue to rise. At the latest event held on 19th October 2021 the Global Dairy Trade index increased by 2.2% to $4,061. SMP and WMP rose by 2.5% and 1.5% to average $3,401 and $3,803 respectively. Butter increased by 4.7% to $5,111. All products recorded an increase on the previous event.

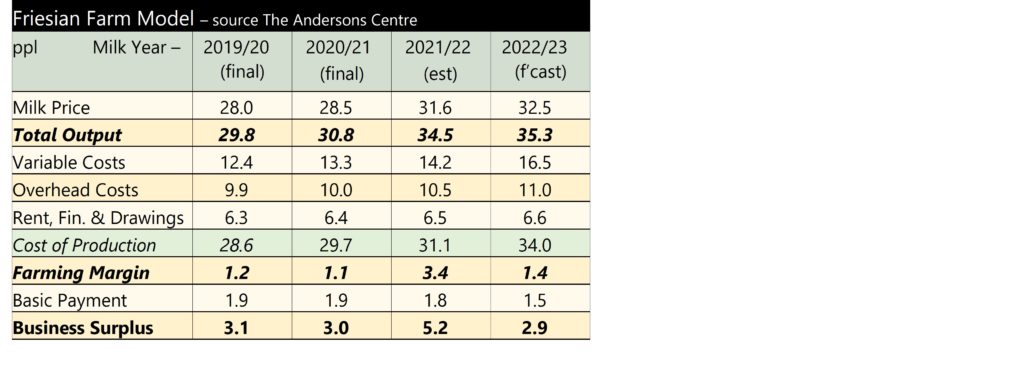

In the UK, spot milk price is trading over 40ppl now, with UK bulk cream looking likely to reach £2.00 per kg. All farmgate prices are increasing, but costs are also rising at an alarming rate. Arla has announced it will be increasing the price paid to its conventional suppliers by 0.9ppl (€1) from 1st November. This will take its manufacturing standard litre to 33.52ppl and the liquid standard litre to 32.26ppl. However Graham Wilkinson, Group Senior Agricultural Director at Arla Foods, has commented that cost inflation is impacting farmers in a way they haven’t seen in many years. He also acknowledged that November’s increase ‘will simply not be enough’ to cover the increase in longer-term costs that so many farmers are now experiencing. This in turn could pose a risk to its supply in the UK and Arla will be focusing on this going forward. Other notable price changes from 1st November include:

- The first to make an announcement was Muller. Its Direct Suppliers (non-aligned) will receive a 1ppl increase from 1st November, taking their standard liquid litre to 30ppl

- The Tesco cost tracker has recorded a 0.7ppl increase meaning Tesco aligned producers from the Muller Group will receive 33.36ppl from 1st November and Arla suppliers 33.11ppl.

- Glanbia has announced a 1ppl rise for its suppliers, taking the manufacturing standard price to 30ppl and the liquid standard litre to 28.99ppl, but this likely to still be on the low side.