The AHDB has recently released its latest beef & sheep Outlook forecasts.

Beef Outlook

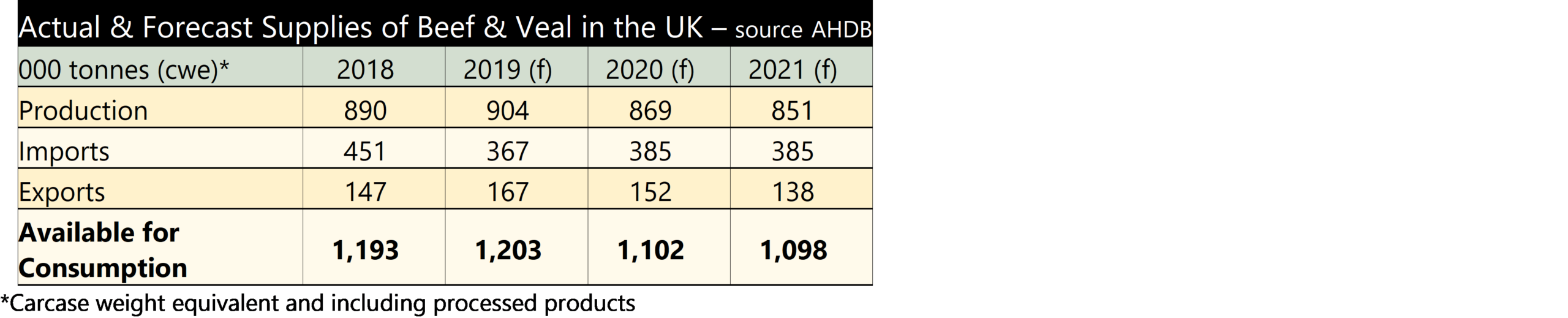

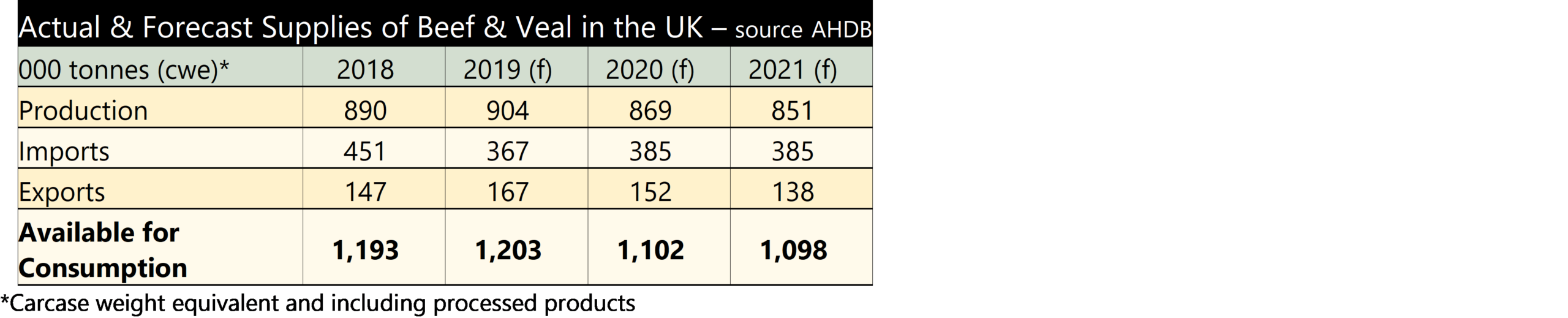

The levy board expects the beef breeding herd (suckler and dairy) to continue to decline, imports are forecast to recover but exports reduce as production falls. In October 2019 the beef breeding herd was 60,000 head (2%) lower than at the same time in 2018. It is expected to reduce by a further 1.7% in 2020, mainly due to a reduction in the suckler herd as the prolonged period of low beef prices takes its toll. The UK dairy herd remains a significant part of beef production and it has also been in decline. However, with the number of dairy females being registered almost the same as last year, this could be an indication the herd is stabilising. The use of sexed and beef semen in the dairy herd has been increasing over recent years, this has seen the number of beef calves out of dairy dams accounting for 45% of births to September, an increase from 36% in 2015.

The number of GB calf registrations to September 2019 stands at 2.16 million, slightly down by 8,000 head (0.4%) compared to 2018. However, there has been an increase in the number of beef calf registrations (up by 1%, or 14,400 head). This is due to an increase in beef semen used in the dairy herd. Data from BCMS shows GB female beef calf registrations to dairy dams increased by 5.2% in the year to September compared to the same period in 2018.

Prime cattle slaughter numbers are expected to reach 2.01 million head for 2019; 1% more than in 2018. Supply is expected to be tighter in 2020 though, particularly during the first half of the year, as data shows there are 2.3% (46,800) fewer cattle aged between 12 and 30 months in October 2019 compared to the same time in 2018. Prime slaughter in 2020 is forecast to be about 1.96 million head, down 2.7% (58,000) than the amount expected in 2019. Looking further ahead, the reduction in prime cattle availability is expected to continue. This is more due to the dairy herd stabilising and young cattle going into the breeding herd rather than for beef production.

Carcase weights have been consistently higher this year, probably due to a number of factors; cattle were in good condition at turnout having been fed more concentrates to make up for the lack of winter forage. It has been a good grass growing season and with low beef prices producers have held on to cattle longer. This winter, diets are expected to revert back to more forage-based and carcase weights are forecast to be slightly lower in 2020. Looking ahead through 2020, with an increase in native breed registrations and more beef coming from the dairy herd, carcase weights are expected to steadily decline as these types of cattle tend to have poorer confirmation. The combination of fewer numbers and lighter carcase weights sees the AHDB reduce its production forecast by about 4% in 2020.

Due to lower prices, beef imports in the third quarter were 23% less than last year, however exports increased by 48%. Irish production has a big effect on imports to the UK. A 6% increase in Irish imports over the first half of the year, put downward pressure on domestic prices. But protests at the end of August by Irish farmers in response to low prices saw production halting and, despite throughput running 5% ahead of the year earlier, it is expected to end the year 3% lower. However, there is now a backlog of cattle in Ireland, in-spec cattle are likely to be prioritised by processors in the short term with heavier out-of-spec cattle expected to be processed over the coming months. This could put pressure on domestic prices if it makes its way over here. Looking further ahead, an increase in calf exports and a shift from beef to dairy cows should see production in Ireland decline. But for 2020, the AHDB is forecasting a 5% increase in imports and a 9% reduction in exports, mainly due to a reduction in domestic production.

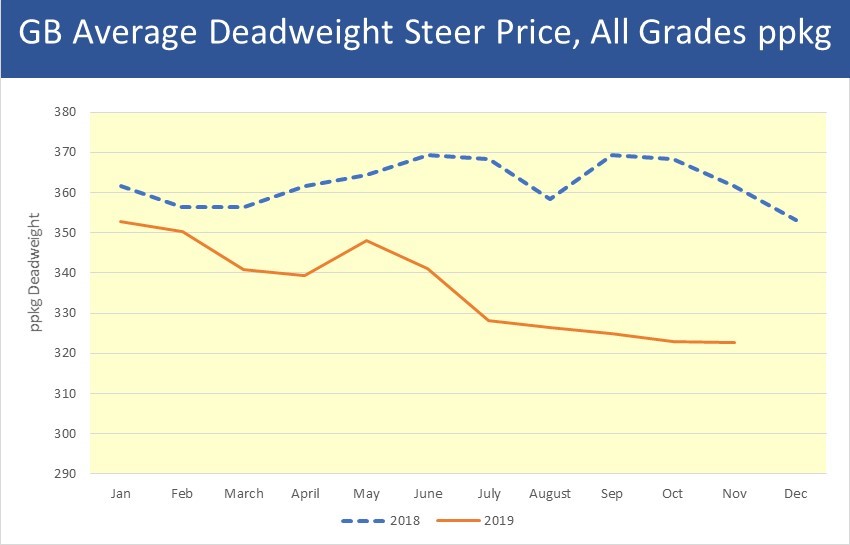

The farm gate beef price has been increasing week-on-week throughout November, but even so, at the end of the month the all steer price was still about 29p per kg less than last year, when it had actually been falling from the beginning of October. An increase in domestic demand is required to boost prices, reports reveal it has been lacklustre over the year, but has picked up over recent months, otherwise we will be relying on exports to support prices.

Sheep Outlook

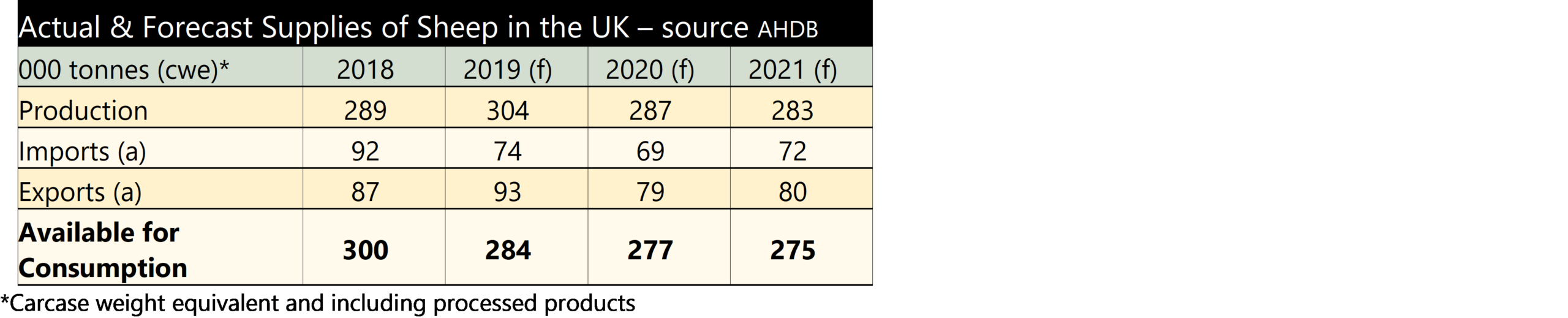

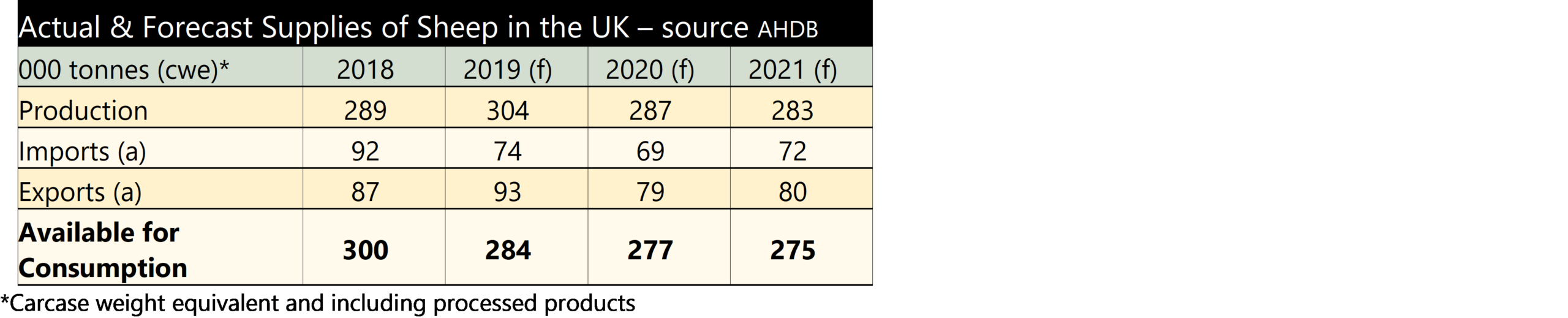

The AHDB is forecasting the breeding flock and the lamb crop to contract in 2020 and also lamb and ewe slaughter numbers to reduce. The contraction of the breeding flock is mainly due to producers’ reactions to uncertainty. With a normal lambing season assumed, the levy board is forecasting a small reduction in the 2020 lamb crop of 400,000 to 16.6 million. In the year to October an estimated 6.6 million lambs from the 2019 crop have been slaughtered, up 7.7% on the year and slightly above the five year average. But the AHDB is expecting around 100,000 fewer lambs to come to market in November and December compared to last year, which will support prices. This tightening in supply is expected to continue into 2020. There is expected to be 100,000 fewer lambs to carry-over into next year. In addition the levy board is forecasting 165,000 fewer new season lambs to be available in the first 5 months of 2020.

The cull sheep kill has been ‘exceptionally’ high throughout 2019, with carcase weights also up. The forecast is for cull numbers and carcase weights to return to more normal levels in 2020. Sheep meat production is forecast to reach 303,800 tonnes in 2019 the highest since headage payments were removed over 10 years ago. However a reduction in the breeding flock will see production declining. Exports generally depend on domestic production; with strong production in 2019, exports have risen. But in addition, New Zealand has diverted its exports to China, so less has been available on the continent which the UK has been able to exploit. During the third quarter exports have risen by 9% to 24,800 tonnes, with most going to France and Germany. In contrast, imports have continued to decline. In quarter three, imports were down by 34% to 12,900 tonnes. Again,this is mainly due to New Zealand directing more of its product to China.

The new season lamb (NSL) price is currently buoyant and continues to rise. It is now comfortably above last year’s, with the liveweight price nearly 20p per kg higher than the five year average. The global lamb situation is supporting prices. Demand is strong, particularly from China due to the effects of African Swine Fever (ASF). Global farmgate prices are high; traditionally GB prices have been above New Zealand and Australia but this price difference has been narrowing since the middle of 2016. Throughout the third quarter of 2019 both New Zealand and Australian prices have been above GB. Recently the NZ price has seen further (unseasonable) gains, whilst the Australian price has fallen. Both NZ and Australia are not forecasting any rise in production for the next year, which will mean global supplies remaining tight and limited imports to the UK. With our own production expected to decline and imports remaining low, availability will be tight if exports can continue as normal (Brexit?), helping to keep farmgate prices healthy.