Steve Barclay has announced a significant update to the agri-environment scheme offering in 2024. This will see:

- The introduction of a combined Sustainable Farming Incentive (SFI) and Countryside Stewardship (CS) Mid Tier offering; designed to be easier to access with a single application portal

- An increase in the number of SFI/CS actions on offer, with 50 new ones announced

- On average a 10% increase in payment rates for SFI and CS agreements as from 1st January 2024

- Paying a premium for ‘high ambition actions’ or for delivering packages of actions that deliver greater environmental benefits.

Combined SFI and CS

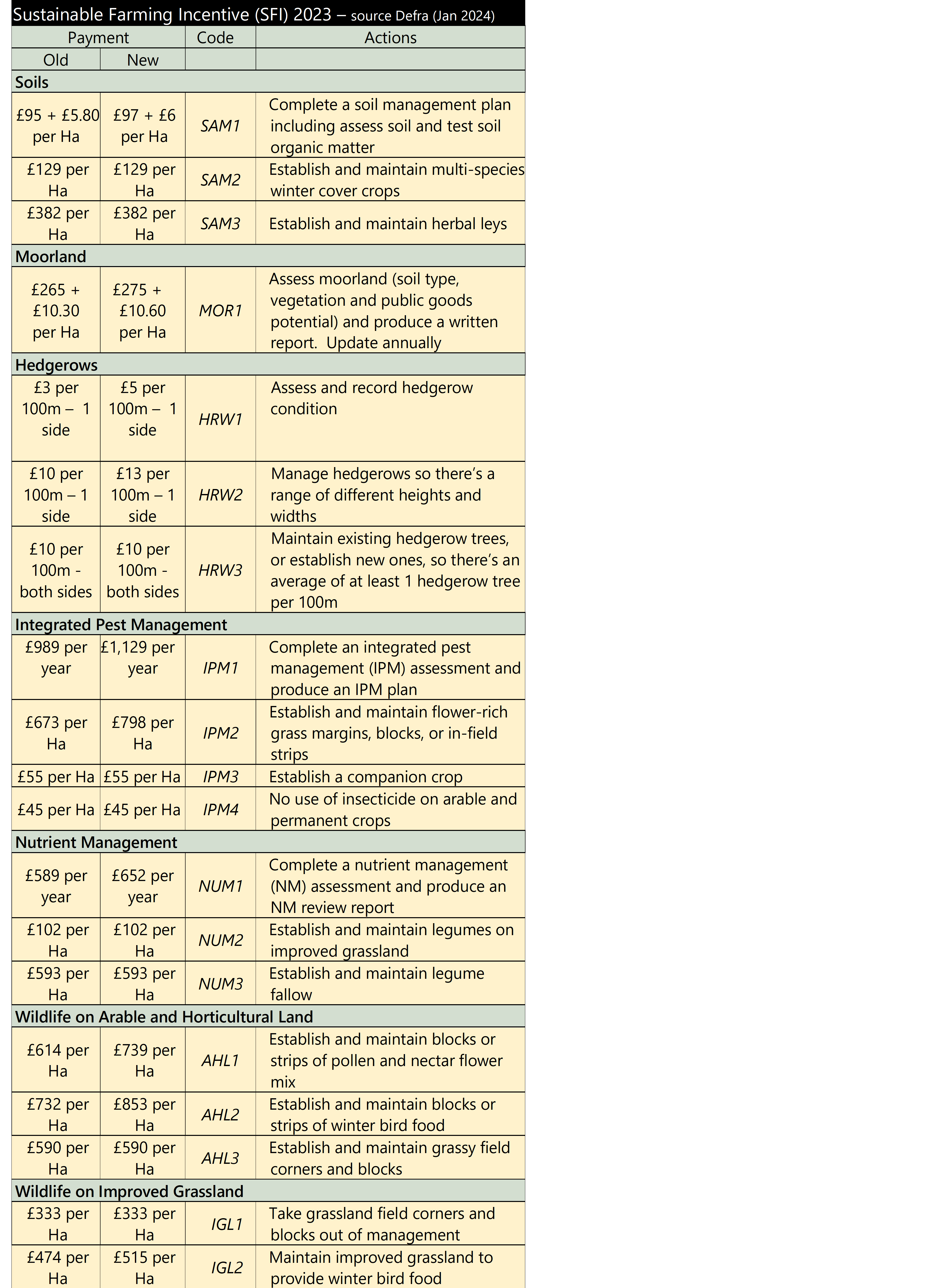

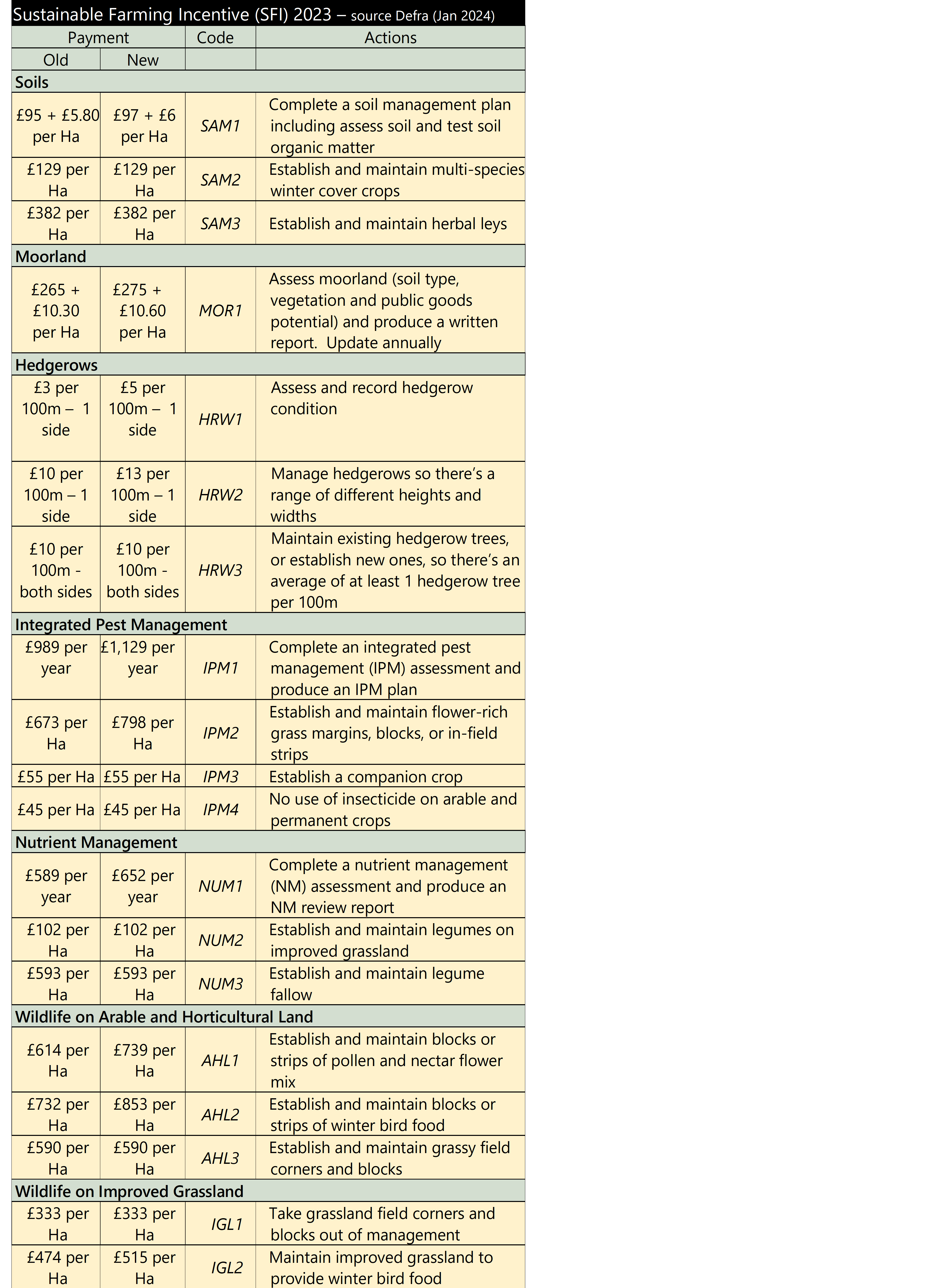

From summer 2024 there will be a single application service for SFI and CS Mid Tier options. It is unclear at this stage whether this will result in one ‘combined’ agreement, but the understanding is that there will be ‘distinct’ CS and SFI agreements at least for 2024. There will be more than 180 options available, with duplication of actions under the two schemes removed wherever possible. The SFI and new CS Mid Tier (and Higher Tier agreements) will be available through rolling application windows, starting in ‘summer’ 2024 with the first agreements commencing in autumn 2024. In the meantime, SFI 2023 remains open for applications with an update to some of the payment rates (see table below).

CS Higher Tier agreements, which are more complex, will continue to operate under a separate application process. However, Higher Tier actions will be made available under the other schemes so farmers will be able to pick from these options, without having a full bespoke Higher Tier agreement, if this is appropriate.

Existing Agreement Holders

Those already with an SFI 2023 agreement will either be able to add to their existing agreement at their annual review or enter into an additional separate agreement in 2024 when the scheme opens. Existing CS Mid Tier agreement holders will be able to apply for a separate 2024 agreement.

Payment Rates

On average, payment rates for options under both SFI and CS have increased by 10%. For those with a live SFI or CS agreement, payments will automatically be increased where applicable, as from 1st January 2024 – agreement holders will not have to do anything. Defra has said it will review all scheme actions and payments rates on a rolling basis. The table below shows the old and new payment rates under SFI 2023.

New Actions

New Actions

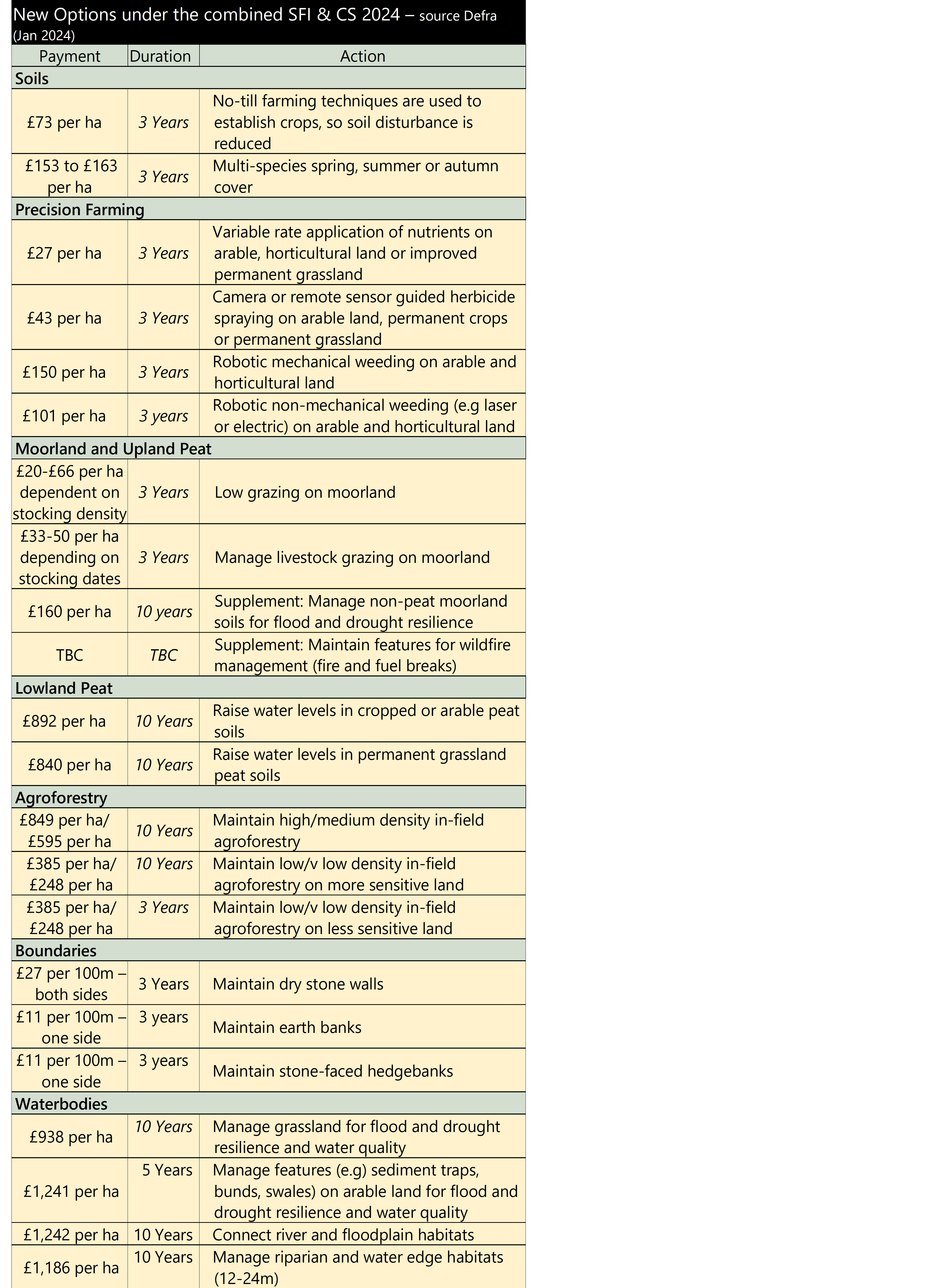

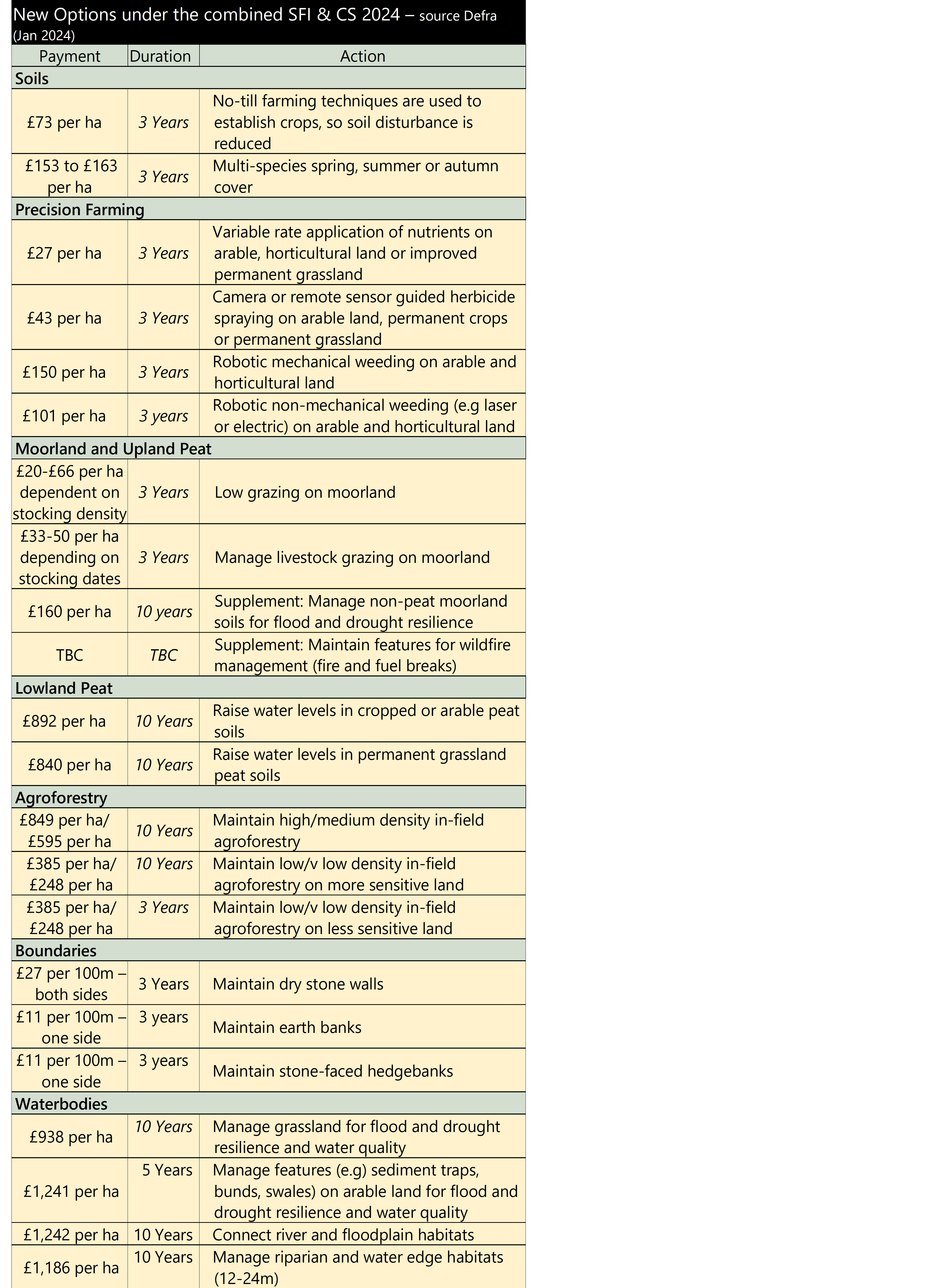

Under the new combined offer there will also be in the region of 50 new actions. These will include support for precision farming and agroforestry for the first time. There will also be an increase in funding for moorland and the introduction of more ‘maintenance’ options i.e for farmers who already have existing habitats. A headline example of this is the increase in the payment for maintaining species rich grassland from £182 per hectare to £646 per hectare. Under the new offering, more of the actions will be available under shorter 3 year agreements (as opposed to 5 years under current CS). This should benefit tenant farmers. The new options will fall under the following headings:

- agroforestry

- precision farming

- priority habitats and threatened native species

- enhancing and restoring waterbodies and water courses

- protecting lowland peat

The table below includes a sample of the new options. As mentioned earlier, it is not yet clear whether there will be a clear dividing line between the SFI and CS in the future, or whether the schemes will merge. It seems that, in 2024 at least, farmers will still be given separate SFI and CS agreements. The new SFI actions for 2024 are taken to be those that have a three-year requirement. Those that require a 5 (or 10) year term are assumed to be CS options.

A full list of all the actions, both existing and new can be found in the Technical Annex at https://www.gov.uk/government/publications/agricultural-transition-plan-2021-to-2024/technical-annex-the-combined-environmental-land-management-offer.

Defra has said it ‘intends’ to confirm details and timescales around these new actions as part of the full scheme details ‘early in 2024’.

Premium Payments

There will be Premium Payments available for 21 high priority actions which Defra has identified as being required to achieve its environmental outcomes and for doing combinations of actions that deliver greater benefits when done together and at scale. A list of these can be found via https://www.gov.uk/government/publications/agricultural-transition-plan-2021-to-2024/agricultural-transition-plan-update-january-2024

SFI 2023 Progress

Defra has reported that 5,300 applications under SFI 2023 had been made as at 18th December. Of these, 2,200 had been started.

New Actions

New Actions